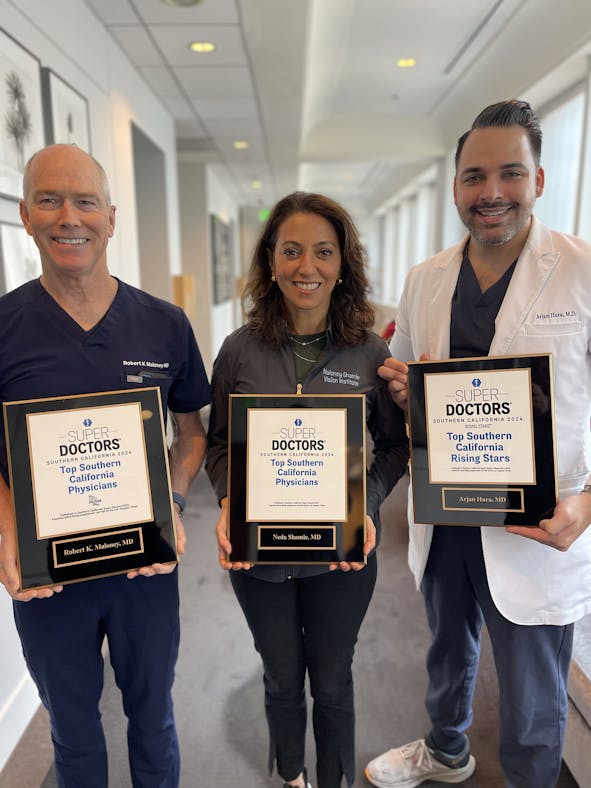

You want the best for your eyes. At the Maloney-Shamie-Hura Vision Institute, we'll help you get that.

Pasadena Location Now Open

Pasadena Location Now Open

Does insurance cover LASIK?

How much does LASIK cost in Los Angeles?

What if I can’t afford to pay all at once?

Can I use my FSA or HSA to pay for LASIK?

Is LASIK really worth the cost?

Are there hidden fees I should know about?

Most insurance plans consider LASIK and other vision correction procedures elective, meaning they are not typically covered. However, we’re happy to provide you with the necessary documentation if your plan offers any type of vision reimbursement or discount program. You can also use FSA and HSA funds to pay for your procedure tax-free.

The LASIK eye surgery cost in Los Angeles can vary based on technology used, surgeon experience, and the specific needs of your eyes. At Maloney-Shamie Vision Institute, our pricing reflects the highest level of care, technology, and results. We’ll provide you with a precise cost breakdown at your free consultation.

We offer multiple financing options through trusted partners like CareCredit and Alphaeon Credit. Many patients qualify for 0% interest promotional plans or low monthly payments that make LASIK surprisingly affordable.

Yes! Both Flexible Spending Accounts (FSA) and Health Savings Accounts (HSA) can be used toward LASIK and other qualifying vision correction procedures. It’s a great way to save on taxes while investing in your eyesight.

Absolutely. Many patients find that LASIK pays for itself within just a few years by eliminating the ongoing expenses of glasses, contacts, and related supplies. Beyond the financial benefits, it’s an investment in comfort, confidence, and quality of life.

No. We believe in complete transparency. During your consultation, we’ll provide a personalized quote that includes everything—pre-operative testing, the procedure itself, and all necessary follow-up visits. No surprise charges. Ever.

© Maloney-Shamie-Hura Vision Institute. All Rights Reserved.